Omicron support announced

If you venture to any pubs or restaurants right now it’s evident that people have heeded the advice to pick and choose their social engagements this Christmas. The impact on the hospitality sector has been severe. Recognising this Rishi Sunak has announced a range of measures to help small and medium sized employers (under 250 employees) and those in the hospitality and leisure sectors. Here’s what we know so far. More will be announced soon.

If you have any questions, please contact David@theaccountancypractice.com or ring 01763 257882

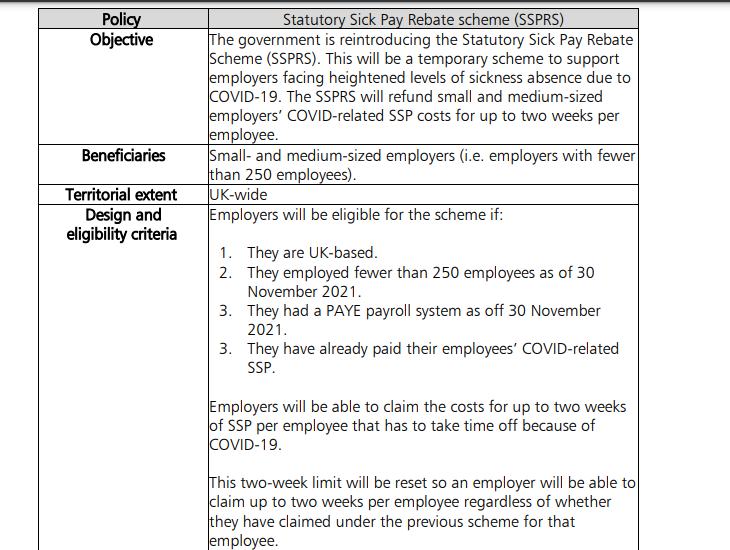

1. SICK PAY – Support for SSP caused by Omicron absence

The Government will pay up to two weeks Statutory Sick Pay for employers who have less than 250 employees, starting with sickness absence on 21st December, with the claim window opening from Mid January.

Employers will be able to make a claim through HMRC from mid-January onwards, using this website: https://www.gov.uk/guidance/claim-back-statutory-sick-paypaid-to-your-employees-due-to-coronavirus-covid-19. This is a temporary scheme to support employers facing heightened levels of sickness absence due to COVID-19. The government will keep the duration of the scheme under review

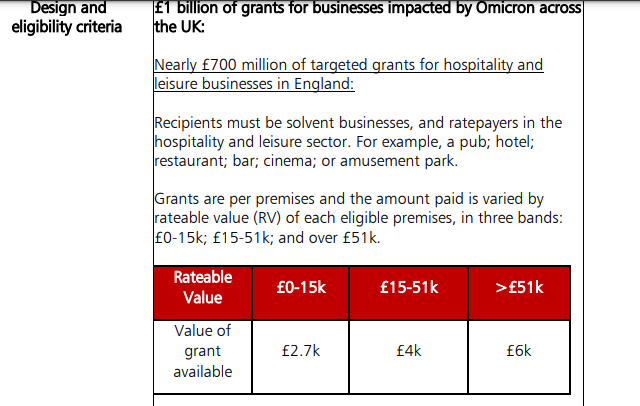

2. NEW GRANTS for businesses in hospitality and leisure from Local Authorities

The government is introducing a new grant scheme to support rateable businesses that are experiencing difficulties because of the Omicron variant, and the dual impact of staff absences and lower consumer demand. Businesses in the Hospitality sectors will benefit from these grants, up to £6,000 for businesses paying rates .

The business rate bands will be familiar to most by now. 0 – £15,000 rateable value will qualify for a grant of £2,700, businesses in the middle tier £15,000 – £51,000 will be eligible for £4,000. With the top band receiving £6,000, in a one off payment.

So to confirm, this will benefit rateable businesses in Hospitality (defined as accommodation, food & beverage services) and some leisure premise.

Recipients must be solvent businesses, and ratepayers in the hospitality and leisure sector. For example, a pub; hotel; restaurant; bar; cinema; or amusement park. Grants are per premises and the amount paid is varied by rateable value of each eligible premises.

However, gyms are not covered by this new grant directly but have been told they can apply for the discretionary grants (referred to as the Additional Restrictions Grant (ARG)) offered by the Local Authorities.

According to the government “Around 200,000 businesses will be eligible for business grants which will be administered by local authorities and will be available in the coming weeks.”

The Additional Restrictions Grant (ARG) will also be topped up so local authorities (LAs) can continue to use their discretion to support other businesses in their area, based on local economic need.

- An increase in the Culture Recovery Fund

This is intended to provide continued support to the cultural sector, £30 million further funding will be made available through the Culture Recovery Fund to support organisations such as theatres, orchestras and museums through the winter to March 2022.

If you have any questions, please contact David@theaccountancypractice.com or ring 01763 257882