What records do you need to keep for your new business?

Welcome to our short and sweet overview which is intended to help people starting up in business. A bit of planning now will save you a headache or two later. It’s one of those jobs which is really easy to put off but having a simple system in place from the start is such good practice and really, you will thank us in a year or so’s time!

The records you keep will vary according to whether you are set up as sole trader or limited company or partnership. Basically, depending on the legal status of your business. If you’d like to see which would suit you best, we’ve made a handy blog post about this, which compares self employment (also called Sole Trader) and a Limited Company set up. If this doesn’t answer your question or you need more detail, feel free to contact david@theaccountancypractice.com.

Most people start off as a sole trader. Also referred to as self-employment.

You will need to register your business with HMRC.

- The business records a sole trader must keep are details of sales and other income, all business expenses, VAT records (if you have registered for VAT) and PAYE records (if you employ anyone). For help with which expenses can be claimed please get in touch!

- These records can be kept in the form of bank statements, sales invoices and purchase invoices.

- The above records need to be kept for 5 years following the submission date (31st Jan) of the relevant tax return.

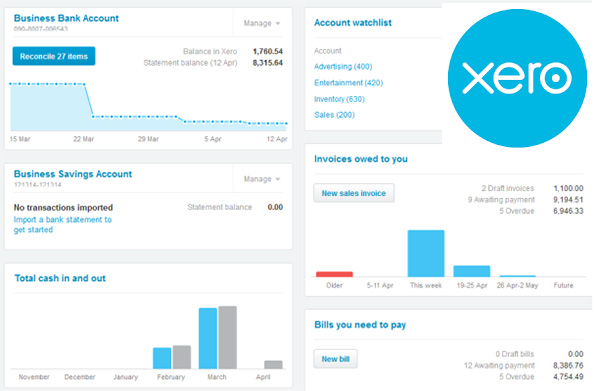

- Records can be kept digitally, which is where an accounting system like Xero, and a receipt scanning app like Dext can really help.

- Dext allows you to take a picture of a receipt for something you are buying for your business on your phone and store it digitally for as long as you need. These receipts can also be uploaded directly into your accounting software, which saves a lot of time and can be done ‘real time’ so you don’t have to worry about that mounting paperwork mountain.

The online systems that are currently in place for sending your tax return into HMRC are soon to be changing to something called Making Tax Digital (MTD). So below we’re going to explain what is going to happen and when.

Making Tax Digital

Under MTD it is proposed that the self assessment tax return will be replaced by five new reporting obligations made during and after the tax year. There will be quarterly updates required and a year-end final declaration.

This measure is due to commence for accounting periods starting on or after 6 April 2023 for self-employed businesses and landlords with business turnover above £10,000.

UPDATE! as at 24th Sept 2021 – the deadline for this starting has been delayed by a year til April 2024. Please click here for that update.

The first tax return under such a system is due in the fourth month of the accounting period. You will then have to file with HMRC every three months. For example, if you have a 5 April year end, your first return will be for the quarter ending 5 July.

Your software should prompt you when to file. Another good reason why it’s best to choose a software package for your business right from the start.

You will be then able to see a year-to-date calculation of the tax owed based on the information provided.

Full details of deadlines are to be confirmed by HMRC, but from draft regulations released in February 2021, it appears reports will be due within one month of each business quarter-end. Not dissimilar to how the VAT is organised.

If you are not already using software for your record-keeping/accounting, you will need to learn how to use a spreadsheet or some type of accounting software or App which is MTD compliant.

You will need a reliable internet connection and a facility to store your electronic data. We recommend Xero.

WHEN WILL THIS START IN PRACTICE?

The first tax year to be affected is 2023-24. This runs from 6 April 2023 to 5 April 2024.

Assuming you choose an accounting period that is the same as the standard tax year, your filing will be as follows:

The first report will be due in August 2023.

The second report will be due in November 2023.

Your Self Assessment tax return for 2022-23 (the previous tax year) will be due by 31 January 2024.

The third report will be due in February 2024.

The fourth report will be due in May 2024.

The fifth and final year-end report will be January 2025.

TAX PAYMENTS

The tax liability will need to be paid by 31 January of the next year (as is currently the case).

You will be allowed to voluntarily pay your taxes as you go: the detail is still being decided.

Eventually, it is possible that you will be required to make four payments per year on account for tax.

If you would like any help with any of this, even if you are not a customer, feel free to give us a call on 01763 257882 or email david@theaccountancypractice.com. We will be happy to help and we won’t charge you for some advice on this.

All the best with your business and we hope this summary has helped you.