The Furlough Scheme

WHAT YOU NEED TO KNOW

Updated 13th May 2020

- FURLOUGH HAS BEEN EXTENDED TO THE END OF OCTOBER 2020. Which means a total of 8 months.

- However for the final three months, August, September and October the government are going to allow people to work part time and they will want a contribution from the employers to pay for the hours the member of staff on furlough is working. The details have not been announced yet but we will keep you up to date as they become clearer.

They are hoping to help businesses who have some work for employees but not enough to occupy them on a full time basis.

We made a little video about it here if you would prefer this method of communication.

- THE FURLOUGH SYSTEM WENT LIVE MONDAY 20th April. Money has been coming into the bank accounts of employers who have applied this week. Click here to apply

- Staff you’ve taken on and added to your payroll on or before 19th March now qualify for the furlough scheme. (The date previously was 28th Feb) This will benefit weekly and bi monthly staff but won’t affect most monthly staff unless you were super efficient and registered them on the system as soon as they started (for starters between 28th Feb and 19th March).

- If you are applying for Universal Credit and were self employed and were worried the money set aside for tax and NI would be counted towards your savings, putting you above the £16,000 threshold, good news. It doesn’t have to count. You need to declare it and show how it equates to approximately 30% of your turnover but beyond that, you should be able to keep it safe for the relevant payment date.

If you would like to subscribe to our newsletter please click here

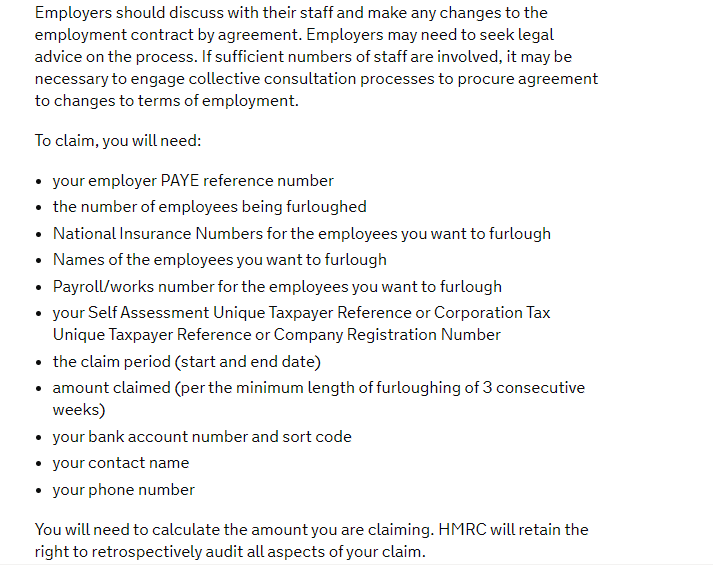

If you administer your own PAYE scheme, this is what you need to prepare for the CJRS/Furlough payment portal.

Do you have an online employer PAYE system in place? if not, (because not everyone gets round to registering when they start their business) please click here to set one up or to find out more

- It is expected that it will take 10 days to process the payments for the first time, thereafter about 5 days.

- You can apply for up to 14 days in advance each month the scheme is in operation (currently for four months, March, April, May and June)

- On the first application you can apply from the date, going back to March 1st, which your staff were officially furloughed and also roll it forward to include your April payment if they are to be re enrolled on the scheme.

- The scheme is being run for a minimum of three weeks at a time. You can have a break, if that works for you (ie they/you need to do some work for your business). You can then ‘re apply’ for a further three weeks and have it rolling back to back. The minimum amount of time someone can be furloughed is three weeks. But you can choose a longer period if that works for you too.

- RECENT EXTENSION TO DATES: Any new starters will need to have been registered in the PAYE system by 19th March to qualify for furlough payments (this has been extended from 28th February). This will benefit weekly and bi monthly staff but won’t affect most monthly staff unless employers were super efficient and registered them on the system as soon as they started (for starters between 28th Feb and 19th March). **

- Very important: you need to inform your employees in writing which states the date from which they are to be staying at home on furlough leave. They are not allowed to work for you during this time. But they can work for someone else.

Click here for a template from ACAS for these letters to your staff about furloughing.

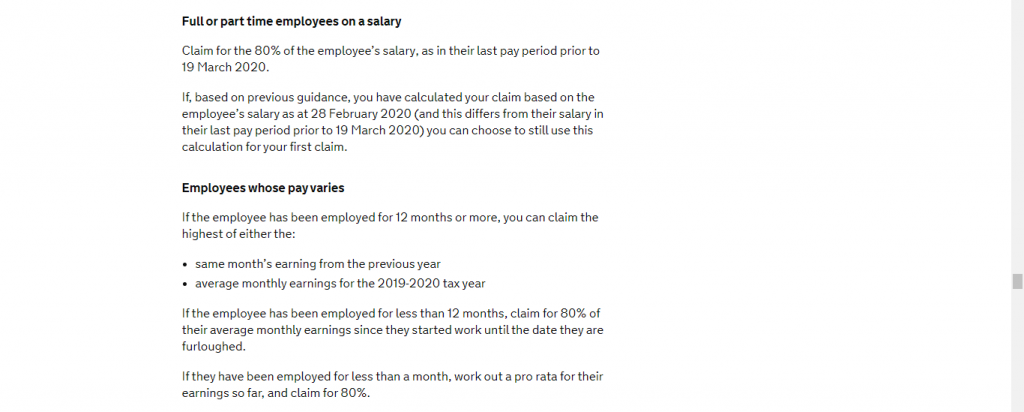

** If your weekly paid staff had a massive increase in hours in the first couple of weeks of March, you may want to recalculate the payment owed for those you are averaging over the previous 12 months. Otherwise the guidance published says you can keep the calculations as they are.

Here’s a link to the relevant government document

We will send out any further information or links as they emerge next week.

Employers who operate the PAYE scheme are effectively the new gatekeepers to enable these new packages of financial social support to reach the people it deems need it most. The Government is using PAYE administrators and their schemes to effectively extend the reach of Social Services support and this is why it has limited the scheme to those who were registered on a payroll scheme on 19th March before the virus affected business in the UK.

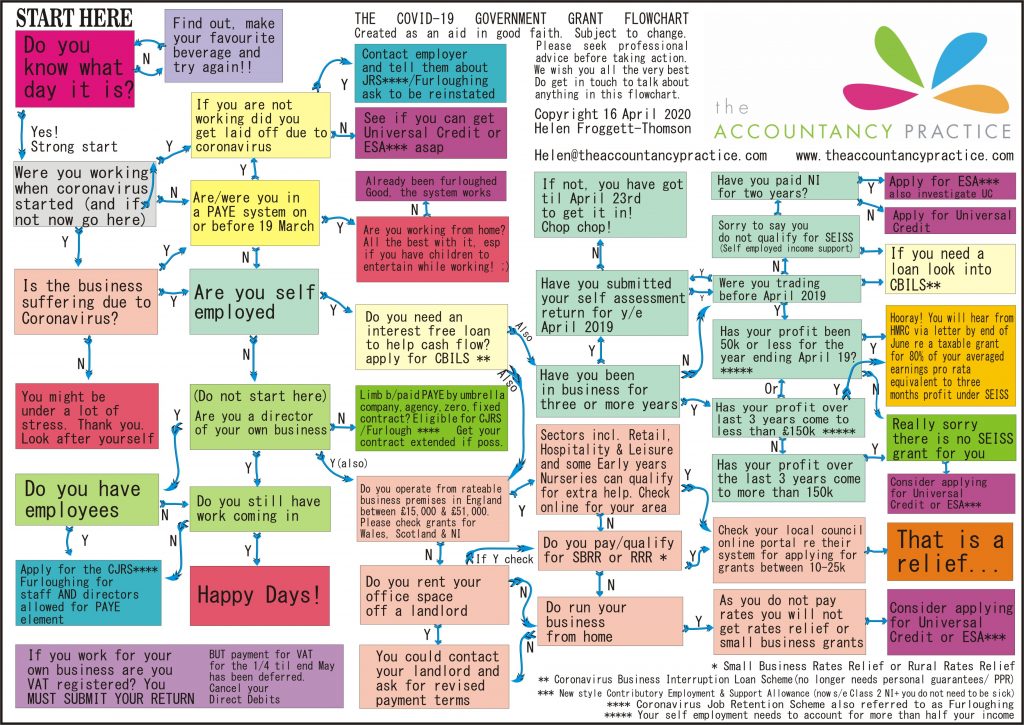

We’ve designed a unique and groundbreaking flowchart to explain the options available to most of the working population.

We’ve also made a video to explain the main principles

Please click here to watch the video explaining your options

Wondering what happens to people who are in the ‘gig economy’? flexible, fixed term, zero hours, seasonal contracts or those working with agencies or umbrella companies? They are all covered if they are enrolled in a PAYE scheme on or before 19th March.

- You will get reimbursed for the Furlough /Coronavirus Job Retention Scheme by the government, which is going live next week. You will be able to claim for 80% of their usual salary, up to £2500 payout per month, per employee. You will also be reimbursed for the National Insurance and Minimum Pension Requirements corresponding to the amount you are paying.

- Very important: you need to inform your employees in writing which states the date from which they are to be staying at home on furlough leave. They are not allowed to work for you during this time. But they can work for someone else. Here’s a template from ACAS for these letters.

- If you need any help calculating your PAYE for your staff, please get in touch. If we do your payroll, we will have been in contact already.

If you need an interest free loan to tide you over to help you pay your staff, please scroll down.

AND IF YOU RECENTLY LET SOMEONE GO, WHO WAS EMPLOYED BY YOU ON 19TH MARCH OR SINCE THAT DATE, YOU ARE BEING ASKED TO CONSIDER RE EMPLOYING THEM SO THEY CAN BENEFIT FROM THE FURLOUGH FINANCIAL SUPPORT

If you employ people on fixed term contracts, zero hours, flexible hours, the key element being that you pay them via your PAYE scheme, you can furlough them.

EXTRA HELP FROM THE GOVERNMENT

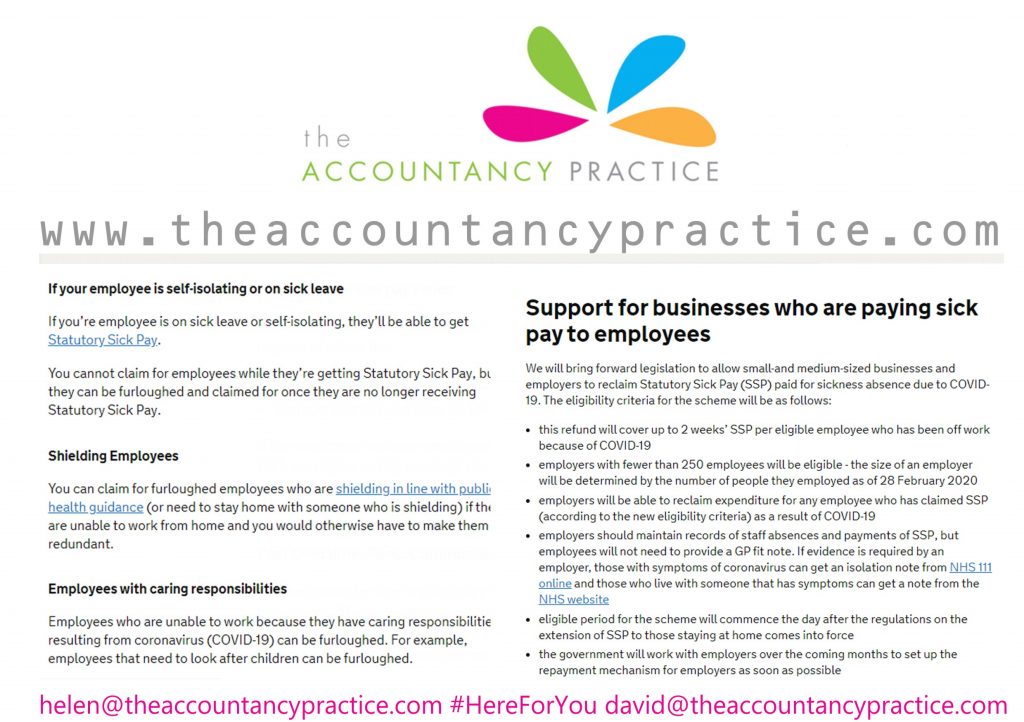

Did you know that the government has pledged to refund you for two weeks of SSP related sick pay AND NOT JUST FOR THOSE WHO ARE SUFFERING FROM CORONAVIRUS – it’s also for people who are shielding or self isolating. Please see the relevant excerpts which explain this.

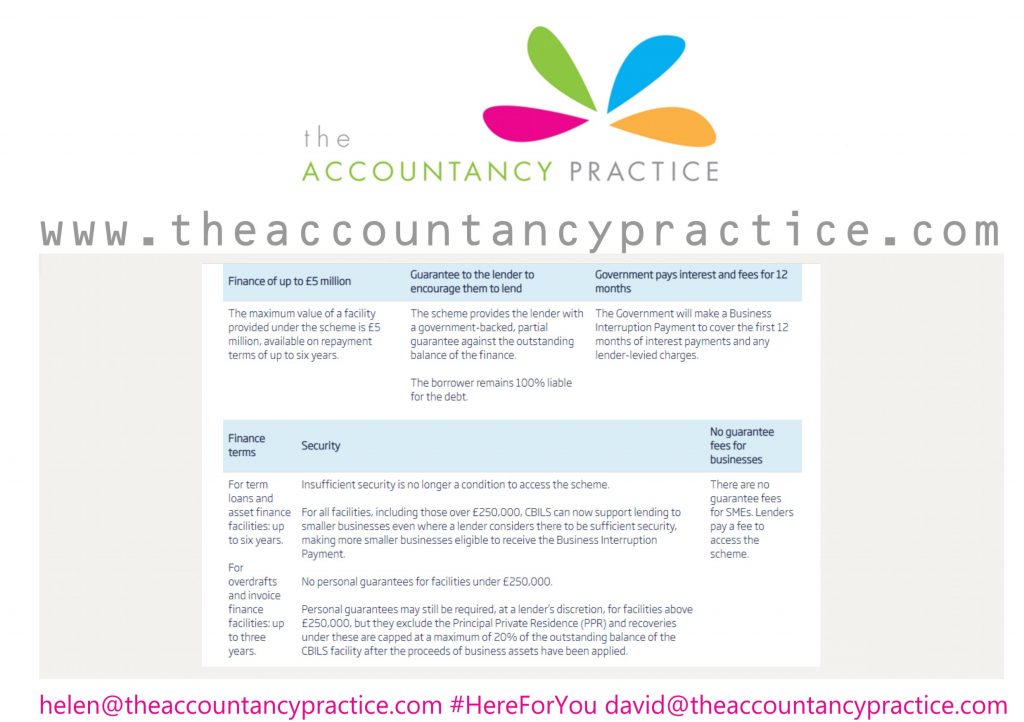

THE CORONAVIRUS BUSINESS INTERRUPTION LOAN SCHEME (CBILS)

Need some finance to tide you over? especially if you are wanting to furlough some staff and need to pay them before you get reimbursed from the government. It is interest free for twelve months (paid for by the government).

If you looked at CBILS a week ago you might have found it lacking but they’ve made some adjustments to support small businesses and the very large ones. Here’s the new link

You no longer need to make personal guarantees or use your home (Principal Private Residence) as security.

‘The devil is in the detail’- summary

- Employers need to write to staff to inform them that they are being furloughed under the Coronavirus Job Retention Scheme. They need this evidence to receive HMRC rebates. The communication needs to be held on record for 5 years.

- Employees need to have been registered in the PAYE system on or before 19th March

- Many people who were in the grey areas have been brought into the fold – the ‘gig’ economy notably. If paid by PAYE and working through umbrella companies, agencies, as seasonal , nannies, ‘limb b’ they are covered by the people who administered the scheme.

- If the fixed term contract, or employment, has ended since 28th Feb or is due to end in the next couple of months, the contract /employment can be extended so furloughing can happen. It is down to the discretion of the PAYE provider as to whether it happens.

- Regular commission (not tips) and overtime can be included in calculations for sales roles.

- ‘New Style Contributory Employment and Support Allowance’ does not now require the claimant to be off sick to apply.

- New style ESA has been amended to include those paying Class 2 National Insurance for 2 years

- Coronavirus Business Interruption Loan Scheme (CBILS) has just made important concessions to small businesses applying for the scheme – no longer requiring Principle Private Residence, or personal guarantees to support a loan sub £250,000. And also included provision for larger businesses.

- Retail, Hospitality and Leisure, and Small Business Grants – Please check your local authority website – some are asking that businesses apply directly.

- Two weeks of SSP will be reimbursed to pay for employees who are self isolating or unwell as a result of Coronavirus, for small businesses (under 250 staff) https://www.gov.uk/government/publications/guidance-to-employers-and-businesses-about-covid-19/covid-19-support-for-businesses

Additional key government reference documents:

https://www.gov.uk/guidance/claim-for-wage-costs-through-the-coronavirus-job-retention-scheme