Winter Economy Plan – in brief – a guide

The government announced a six month plan of further financial support on Thursday 24th Sept despite having said there would be no further SEISS (self employed income support scheme) support etc, so this must indicate they are concerned. And rightly so.

The government announced a six month plan of further financial support on Thursday 24th Sept despite having said there would be no further SEISS (self employed income support scheme) support etc, so this must indicate they are concerned. And rightly so.

If you’d like to read about the 16 points we’ve made about the new Jobs Support Scheme, please click here. It is the replacement for the Furlough scheme (also called the Job Retention Scheme) which closes at the end of October.

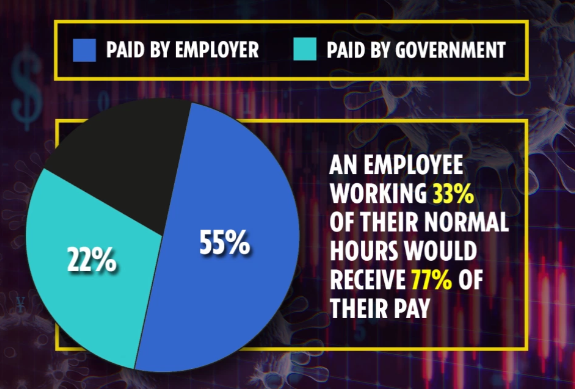

It would seem that HMRC are trying to provide ‘parity’ in terms of proportionate help (on the surface). So the rough percentage of salary grant employees are being offered (22% or less) and the self employed (20%) is being touted as comparable. Of course, the schemes are wildly different, in that the self employed person has to show that their business has been affected and that is not the case for small businesses but there you go.

JOBS SUPPORT SCHEME

In a nutshell however, the scheme has been devised to benefit employees and to incentivise employers to keep people on even if the demand isn’t there at present.

From November 1st, the government is subsidising the hours not worked by an employee, assuming that there’s not enough demand/work to justify a return to full time working when the furlough scheme ends. And asking the employer to do the same. While paying in the usual way for the hours actually worked. You have to work a minimum of a third of your usual contracted hours to qualify for the scheme.

If you’d like to read more about this, click here

SEISS – SELF EMPLOYMENT INCOME SUPPORT SCHEME

What is the SEISS extension scheme offering?

So the initial criteria for qualifying for the first scheme still stands.

Please read this link for those criteria if you’d like a refresher.

However, if you qualified for the other two grants, you probably qualify for the next couple IF YOUR TURNOVER HAS BEEN AFFECTED IN A NEGATIVE WAY by the current covid situation.

So we’ve been used to 80% and 70% and now it’s….. 20%.

And there’s payments for two months ‘missing’ (if you were hoping for continuity and consistency)

While the government claimed the grants were not for specific months, just ‘quarters’ the first one was payable in May (so March/April/May) and the second one was notionally (June/July/August) but the third one is Nov/Dec and Jan and the fourth one (amount of support not yet announced) is for Feb/March/April.

The maximum payout you can expect if your profit was under £50,000 for the trading year ending April 2019 is £1875.00. For three months. It was capped at £7500.00 when the scheme was first announced in March (for a point of reference).

Here’s the official line from HMRC

Good luck out there.

As ever, give us a call on 01763 257882 or email David@theaccountancypractice.com or this blog post author helen@theaccouuntancypractice.com if you’ve got any questions. It doesn’t matter if you’re not a client. We won’t charge you for chatting to us about this.

VAT CUTS, PAYMENT PERIODS, SELF ASSESSMENT PAYMENTS ON ACCOUNT

The 5% vat rate for tourism and hospitality remains in place til end of March 2021

If you deferred your VAT payments til the end of March next year, you may be pleased to hear that there will be an option to pay over the financial year 21/22 year instead, in 11 interest free payments.

If you took advantage of the option to deter your self assessment payment from July to this coming January 21, you may be pleased to learn that you will now have an extra year to pay this amount, with the payment not being required til January 2022.

LOANS AND THEIR REPAYMENT

The period for repayment of the Bounce Back Loans and CBILS loans has been increased from 6 years to 10 years.

The various loan schemes have been extended til November

If you would like to read the government’s official line on any of the above, please click here

If you’d like to speak to the author of this post please email helen@theaccountancypractice.com or if it’s a more general accounting enquiry please email David@theaccountancypractice.com or ring us on 01763 257882